Note: Supplemental materials are not guaranteed with Rental or Used book purchases.

Purchase Benefits

What is included with this book?

The New copy of this book will include any supplemental materials advertised. Please check the title of the book to determine if it should include any access cards, study guides, lab manuals, CDs, etc.

The Used, Rental and eBook copies of this book are not guaranteed to include any supplemental materials. Typically, only the book itself is included. This is true even if the title states it includes any access cards, study guides, lab manuals, CDs, etc.

The Gathering Economic Storm

On the hope of our free nation rests the hope of all free nations.

-- John F. Kennedy

America: What Went Right

It was difficult for the three of us to write a book titledThe End of Prosperity.

We're not doom and gloom people; we're natural optimists. And we're not part of the trendy set of intellectuals who like to trash our nation, blame America first for all the world's problems, or worst of all, predict with glee America's downfall as some kind of punishment for our alleged past environmental crimes, racism, financial mismanagement, greed, overconsumption, imperialism, or whatever the latest chic attack on the United States is.

By contrast, wedobelieve in the idea of American exceptionalism and that this nation is, in the words of our hero Ronald Reagan, "a shining city on a hill." The Gipper said it eloquently in his 1980 speech at the Republican National Convention in Detroit when he proclaimed that it was "divine providence that placed this land -- this island of freedom here as a refuge for all those people in the world who yearn to breathe freely."1 Yes, we certainly agree.

We're also well aware that American skeptics who have written over the last two or three decades about the end of the United States' economic might have gotten the story 180 degrees wrong. There've been dozens of wrongheaded books, many which became best sellers, fromAmerica: What Went Wrong?(Bartlett and Steele), toBankruptcy 1995: The Coming Collapse of America and How to Stop It(Figgie and Swanson), toThe Great Depression of 1990(Ravi Batra), toThe Rise and Fall of the Great Powers(Paul Kennedy), toThe Day of Reckoning: The Consequences of American Economic Policy Under Reagan(Benjamin Friedman), all forecasting America's impending economic collapse. So much gloom. These pessimists were about as right as the record producers who turned down a contract with the Beatles in 1962 because in their famous assessment, "guitar groups are on the way out,"2 or the venture capitalists who rolled with laughter over the idea of a computer in every home, and then told Bill Gates to go take a hike.

Many of today's leading liberals who are advising Barack Obama and the Democrats in Congress are the same people who predicted in the late 1980s that Japan, with its sophisticated government-managed industrial policy economy, would take over the world in the 1990s and the early twenty-first century. Yes, those predictions were made at the early stages of one of the greatest and longest financial collapses in world history. Lester Thurow wrote after the Berlin Wall came down: "The Cold War is over. Japan won."3 The Nikkei Index stood at 38,000 in 1989 and fell to below 8,000 in 2003, an 80 percent decline.4 So in the 1990s while the U.S. stock market more than doubled, the Japanese stocks fell by about half.

Where the declinists on the left foresaw America's demise in the eighties and nineties and predicted a future that looked like the grim portrait of cities in movies likeBlade RunnerandBatman, we forecast growth and a cornucopia of financial opportunity and a coming burst of prosperity. We believed that Ronald Reagan had the right prescription for the malaise of the 1970s. Reagan focused like a guided missile on the big problems that had come to cripple the U.S. economy: rampant inflation, high tax rates, a crushing regulatory burden, and runaway government spending. Call the Reagan economic agenda Reaganomics, supply-side economics, or free market economics -- critics can even keep on calling it Voodoo or "trickle down" economics -- but what is undeniable is that the economy surged in the 1980s and 1990s as if injected with performance-enhancing steroids.

Movin' On Up

Anyone who followed the declinists' advice about selling America short lost a lot of money. After the Reagan tax cuts and the conquering of inflation in the early 1980s America's net worth -- or what we call America, Inc. -- climbed in real terms from $25 trillion in 1980 to $57 trillion in 2007.5 More wealth was created in the United States over the past twenty-five years than in the previous two hundred years. The economy in real terms is almost twice as large today as it was in the late 1970s. Or consider these income gains:

-Between 2001 and 2007 alone the number of Americans with a net worth of more than $1 million quadrupled from 2.1 million to 8.9 million, according to TNS Financial Services.

- In 1967 only one in 25 families earned an income of $100,000 or more in real income (in 2004 dollars), whereas now, almost one in four families do. The percentage of families with an income of more than $75,000 a year has more than tripled from 9 percent to almost 33 percent from 1967 to 2005.

- The percentage of families in all of the income groups between $5,000 and $50,000 has dropped by nineteen percentage points since 1967.

These figures confirm what we believe to be the most stunning economic accomplishment in America over the past quarter century: the trend of upward economic mobility in America. A poor family in 1979 was more likely to be rich by the early 1990s than to still be poor.7 This is the sign, not of a caste economic system, but of a meritocracy where people get ahead through hard work, saving, and smart investing. And moving up the ladder is the rule, not the exception, in America today.

There's a wonderful new video on Reason.tv called "Living Large" that can be viewed on YouTube. In it, comedian Drew Carey goes to a lake in California where people are relaxing on $80,000 twenty-seven-foot boats and goofing around on $25,000 jet skis that they have hitched to their $40,000 SUVs. Mr. Carey asks these boat owners what they do for a living. As it turns out, they aren't hedge fund managers. One is a gardener, another a truck driver, another an auto mechanic, and another a cop.

Today most of the poor own things that once were considered luxuries, such as washing machines, clothes dryers, refrigerators, microwaves, color TV sets, air conditioning, stereos, cell phones, and at least one car. Table 1-1 shows that, amazingly, a larger percentage of poor families own these consumer items today than the middle class did in 1970.

One of the big dividends of this technology age is how rapidly new inventions become affordable to the middle class. It took more than fifty years for electricity and radio to reach the average household, but newer inventions, such as cell phones, laptop computers, and color TVs, became affordable within a matter of a few years (see Figure 1-1). We are democratizing wealth in America, and new things that were once the exclusive purchases of the rich are now regarded by Americans of all income groups as not just necessities, but entitlements. Young people today can't even fathom a society without cell phones, iPods, laptops, DVD players, and the like. They think that to live without these things is to be living in a prehistoric age. But watch a movie from twenty years ago and you will laugh out loud seeing big clunky black machines that weighed as much as a brick, gave crackly service, and cost $4,200. Now cell phones are about forty-two dollars -- even disposable. And the cost of making calls has dropped dramatically, too.

Here's an even more amazing statistic: Americans in 2007 spent more than $1 billion just to change the answer tune on their cell phones.9 And yet Americans are still far and away the most generous citizens of the planet, giving more than $306 billion in 2007 to charity to help others, while 60 million Americans volunteer time for nonprofits, hospitals, churches, and other causes.

In the late 1990s Barbara Ehrenreich asked in theNew York Times, "Is the Middle Class Doomed?" She then noted that "some economists have predicted that the middle class will disappear altogether, leaving the country torn, like many third world countries, between an affluent minority and throngs of the desperately poor."11 Here's the truth. The purchasing power of the median-income family, that is, families at the midpoint of the income continuum, rose to $54,061 in 2004, an $8,228 real increase since 1980.12 The middle class is not disappearing, Barbara, it is getting richer, as shown in Figure 1-2.

There's no question that the poor and even the middle class face real financial challenges -- paying for health care, college tuition, making mortgage payments in a downward spiral of housing values, and filling up the gas tank at the pump. But we always have to ask the question: compared to what? Today the poor generally have access to more modern goods, services, and technologies than the middle class did in the middle of the last century. As Nobel Prize-winning economic historian Robert Fogel wrote in 2004: "In every measure that we have bearing on the standard of living...the gains of the lower classes have been far greater than those experienced by the population as a whole."

A recent study by the Congressional Budget Office came to the eye-popping conclusion that from 1994 to 2004 Americans in the bottom 20 percent of income actually had the highest increase in incomes.14 Yes, you read correctly: The poor got richer faster than the rich did. A subsequent study by the Treasury Department found the same thing.15 When you track real families -- real people -- over time, you find that people who are poor at the start of the period you examine have the biggest subsequent gains in income. Amazingly, the richer a person is at any given point in time, the smaller the subsequent income gains. Those in the top 1 percent actually lose income over time. You won't read that in theNew York Times, because the media treat facts like this as if they were closely guarded state secrets. And for the media, good news is practically a contradiction in terms when covering the American economy: If it's good, then it's not news. But no matter how you slice or dice the data, this has been a shared prosperity (see Table 1-2).

Today we are not just a nation of earners, but of owners. In the late 1970s only about one in five Americans owned stock. Today slightly more than one-half of all households are stock owners, or capitalists. To borrow a phrase from the Prudential TV commercials: Workers and families own a piece of the rock in America. This is one of the most important and uplifting demographic changes of recent times in the United States. We are becoming a nation of worker/owners. Americans now increasingly own the means of production. Marxism is dead. There is no inherent death struggle between workers and capitalists because in America they are one and the same.

We could go on, but the enduring lesson we hope we've documented is how much the standard of living of Americans rose in the short time period since 1980, once we got our economic policies in order and rewarded growth. We only wish that this were the end of the beginning of this golden age of prosperity, not the beginning of the end.

Don't Know Much About History

So what explains our sudden turn toward pessimism? Why do we now forecast the End of Prosperity?

The short answer is that we aren't just optimists, we are first and foremost realists. And we are now witnessing nearly all of the economic policy dials that were once turned toward growth being twisted back toward recession. The problem is not a crisis of the American spirit or work ethic, or value system, or some inevitable decline due to complacency. It is that our politicians in both parties, but especially the liberal Democrats, are getting everything wrong -- tax policy, regulatory policy, monetary policy, spending policy, trade policy. We call this the assault on growth. The political class seems to be almost intentionally steering the United States economy into the abyss -- and, to borrow a phrase from P. J. O'Rourke, the American electorate, alas, seems ready and willing to hand them the keys and the bottle of whiskey to do it.16 Almost all of the catastrophic policy mistakes are being coated with good intentions: to help the poor, the middle class, the environment, or the unemployed; to hold down prices, "obscene profits," or irresponsible CEO pay; or to close the gap between rich and poor.

Let us interject an anecdote that goes a long way toward explaining the backwardness of the current political environment. In a Democratic presidential primary debate in Philadelphia, the following interchange occurred between Charlie Gibson of ABC News and Barack Obama on the senator's plan to raise the capital gains tax. The discussion went like this:

Gibson:Senator, you have said you would favor an increase in the capital gains tax. You said on CNBC, and I quote, "I certainly would not go above what existed under Bill Clinton," which was 28 percent. It's now 15 percent. That's almost a doubling, if you went to 28 percent. But actually, Bill Clinton, in 1997, signed legislation that dropped the capital gains tax to 20 percent.

Obama:Right.

Gibson:And George Bush has taken it down to 15 percent. And in each instance, when the rate dropped, revenues from the tax increased; the government took in more money. And in the 1980s, when the tax was increased to 28 percent, the revenues went down. So why raise it at all, especially given the fact that 100 million people in this country own stock and would be affected?

Obama:Well, Charlie, what I've said is that I would look at raising the capital gains tax for purposes of fairness. We saw an article today which showed that the top fifty hedge fund managers made $29 billion last year -- $29 billion for fifty individuals. And part of what has happened is that those who are able to work the stock market and amass huge fortunes on capital gains are paying a lower tax rate than their secretaries. That's not fair.

Gibson:But history shows that when you drop the capital gains tax, the revenues go up.

Obama:Well, that might happen, or it might not.

This amazing exchange left us scratching our heads and wondering whether this gifted orator who can fill stadiums with 70,000 or more adoring fans and followers and says that he is promoting "The Audacity of Hope" has even the slightest clue about how economics works in the real world. How jobs are created. How entrepreneurs and risk takers create wealth. Mr. Obama admitted in front of a national television audience that he would raise the capital gains tax even if the revenues would fall -- because this is the "fair" thing to do. Fair to whom? Everyone -- and we mean everyone -- loses when a tax increase lowers revenue. The government, the taxpayer, the economy, American workers.

But this was only the beginning of the onslaught, not the end. We're worried that tax rates are going to go up across the board over the next few years -- income tax, capital gains taxes, dividend taxes, Social Security taxes, and estate taxes. Even many of our friends who believe in limited government say that taxes must rise over the next five or ten years to pay for the stampeding cost of Medicare, Medicaid, and Social Security. We're worried that the dreaded alternative minimum tax, which is now paid by some 5 million upper-income families, will be expanded to 25 million mostly middle class families as early as 2009. We've seen the greatest era of tax rate reduction in decades all over the globe in Iceland, Ireland, Britain, Sweden, even France. By 2010 the United States could be the nation with the highest tax rates on investment, savings, corporate profits, and stock ownership of any nation in the world. How will America compete and win in a global economy with that millstone around the neck of U.S. businesses? That can't be healthy for the U.S. economy.

One thing is certain: If Washington turns all the policy dials in the wrong direction, just as sure as the sun rises in the morning, the U.S. economic growth machine will grind to a halt. It's already happening, as evidenced by the housing crisis, high gas and food prices, and the collapse of the dollar. That is, in fact, the central premise of this book: Economic policy matters. Incentives matter. Prosperity doesn't happen by accident, and growth is not the natural course of events; it has to be nurtured and rewarded.

A corollary to this premise is that when the politicians start to get the wires crossed, as on the engine of a finely tuned race car, bad things can happen in a hurry. When we got our policies terribly misaligned in the 1930s during the Great Depression the economy didn'trecover for twelve years, and then only because we entered a world war and the economy became a military emergency mobilization operation. The explanation of the Great Depression and the human misery it wrought is not an unsolved mystery.18 The twelve-year economic slide was a result of trade protectionism, high tax rates, a contractionary monetary policy, and a New Deal mishmash of government programs that were well intentioned, but made things worse, not better. The result was the worst stock market performance in history, bread lines and one in four Americans out of a job.

Then in the 1970s, during the era of malaise and stagflation, the over-regulated, overtaxed and overinflated U.S. economy sank from the exhaustion of carrying around these economic Quaaludes, and the stock market went Helter Skelter. We should have learned from these eras of despair that policymakers can do a lot of harm to financial conditions, family incomes, and American competitiveness -- and they can rain down destruction in a hurry.

If anything, now that we live in a globalized economy without walls and with information traveling at warp speed, the penalty for getting economics wrong is more swiftly imposed and more punitive than in earlier times. Capital markets adapt to policy changes not within months or weeks but within hours, minutes, and even seconds. Tens of billions of dollars of capital investment can move from one nation to another in the time it takes global capitalists to right-click on the computer terminal. That we live in an era of quicksilver capital is a liberating force for good, not evil -- it disciplines rogue governments for intervening in markets and for making horrendous policy mistakes. But it doesn't guarantee that politicians won't screw up in the first place.

The Four Killers of Prosperity

The tanking of the U.S. economy in the 1930s and the 1970s demonstrates the dangers of the four great killers of prosperity and bull markets. Those killers are:

- Trade protectionism.

-Tax increases and profligate government spending.

-New regulations and increased government intervention in the economy.

- Monetary policy mistakes.

So what can happen when we get these policies wrong? Again, the 1970s is instructive. Prices started the decade rising at 5 percent, then 6 percent, then 9 percent, then 11 percent, and then, in Jimmy Carter's last months in office, at a 14 percent inflation rate. And when unions scored three-year contracts with 30 percent pay raises in the late 1970s, the hard-hat workers finally discovered they had been hoodwinked: Their fat raises were falling behind stampeding price increases. Families saw their biggest decline in real after-tax incomes since the Great Depression, with the median family losing almost $3,000 of income (in today's dollars) thanks to high unemployment and high inflation. The highest tax rates hit 70 percent, and in some states the combined federal and state tax rate exceeded 80 percent. That meant that the government was entitled to four-fifths of the last dollar earned on investment. Regulations and government spending also went berserk. Investing, working, starting a business, taking risks -- all of which are economic virtues in our book -- were punished rather than rewarded. The result, as we see in Figure 1-3, was the worst stock market performance since the Great Depression. After-inflation, stocks lost 6.1 percent of their value compounded annually for sixteen years.

But now take a close look at the second half of the chart and you will see the astonishing and nearly uninterrupted surge in stock values starting in the early 1980s when taxes and inflation were cut. Our friend Larry Kudlow of CNBC TV'sKudlow & Companycalls this "the greatest story never told." And we agree. Instead of losing 6 percent per year the S&P 500 rose at an annual real rate of just under 8 percent. The Dow Jones Industrial Average soared from 800 in 1982 to 12,500 at the time of this writing in early 2008. If we have another quarter-century run like that, by 2033 the stock market will be at 120,000.

In the 1980s, we rediscovered prosperity through the new agenda of supply-side economics. Ronald Reagan embraced as a centerpiece of his economic philosophy the idea of the Laffer Curve, which in shorthand tells us that when tax rates get too high, they smother growth and can cost the government more revenue than they raise.

In the 1980s and 1990s and early 2000s most of the obstacles to growth were cleared away. Taxes, tariffs, regulations, and inflation weren't eliminated, but they were tamed. Yes, there were policy mistakes along the way, there were periods of irrational exuberance in tech stocks and housing and savings and loans, there were tax increases under Reagan and Clinton that did more harm than good, there were protectionist tariff policies that set back the trade liberalization agenda. But the unmistakable trend over the period was toward stable prices, a dependable and strong currency, lower and flatter tax rates, freer trade, a lighter hand of regulation in key industries ranging from financial services to transportation to telecommunications and energy, somewhat moderated levels of federal spending, welfare reforms that rewarded work over dependency, the elimination of most price controls, and so on.

Without these interferences the economy blossomed and U.S. industries reawakened from the wicked spell of stagflation. The United States was unquestionably the global winner in the race for capital around the world. America soaked up some $5 trillion in net capital investment from around the world.20 Smart money got parked in America, because this is where the growth and innovation occurred and where the value was added. (Think of the Silicon Valley high-tech revolution.) The after-tax, after-inflation return on a dollar of investment was more than doubled in many cases, so the dollars flowed in. These growth policies also attracted human capital, as smart and ambitious people knocked down the doors to stream in to fill many of the 40 million jobs that appeared practically out of thin air.21 And the United States became the world's premier economic superpower. By 2005, according to the U.S. Department of Labor, the amount of production per person in America was $42,100, versus $34,000 in Canada, $31,000 in Japan, $30,200 in France, $29,800 in Germany, and $25,500 in Italy.

Much of this growth was also fostered by the dawning of the age of the microchip and all the attendant fabulous technological advances, which have played such a vital role in this wild and wonderful ride. Ingenious and daring entrepreneurs from Bill Gates to Fred Smith to Larry Ellison to Google founders Sergey Brin and Larry Page launched whole new industries and made billions of dollars for themselves and billions more for workers and society. One of the often-repeatedlies about the U.S. economy is that "we don't make anything in America anymore." Nonsense. We have created whole new 21st-century knowledge-based industries. Our point is that supply-side economic policies created the fertile environment for the entrepreneurial spirit that has made the information age economy such a brilliant success. The technological explosion and the Silicon Valley revolution might not have happened when it did and where it did had it not been for the proinvestment climate fostered by supply-side policies. It's a lot harder to raise the money to start a new technology firm with 70 percent tax rates and a 40 percent real capital gains tax rate than with tax rates half that high.

Around the world other nations observed how the American economy raced forward and ran laps around their own economies. And these nations in effect shrugged their shoulders and said: If you can't beat 'em join 'em. They moved gradually, but recently with increasing urgency, to adopt the supply-side, or "the American model" of free markets and low taxes, to emulate what they saw had worked so brilliantly in the United States. Tax rates in the developed nations around the world are on average twenty to twenty-five percentage pointslowertoday than they were in the early 1980s. China, India, Vietnam, Eastern Europe, and now -- we never thought we would see the day -- even the nations of old Europe, Germany, Sweden, Italy, and yes, France, are shedding the welfare states' state-owned enterprises, and the confiscatory tax policies and are reengineering their economies in a more capital-friendly way. Good for them. Why aren't we doing the same?

Which Brings Us to Today

We now live in troubled and turbulent economic times. In mid-2008 Americans are feeling uneasy and even slightly panicked about their financial future. They are worried about jobs, health care, and the high price of energy and food. They are also concerned about the housing crisis and making mortgage payments on homes that are falling in value. Many people have told us: The End of Prosperity isalready here.Polls reveal a widespread gloom among voters not seen since the early 1980s.

So what course will we take to fix things?

We are now told by politicians that government will solve all these problems for us. TheNew York Times Magazineran a lengthy article about the end of laissez faire economics in America -- as if we ever had that. TheTimesadvised that once upon a time free market champion Milton Friedman taught us that it was the botched job of government and politicians that created the Great Depression. But now in 2008, "a bipartisan chorus has declared that unfettered markets are in need of fettering. Bailouts, stimulus packages, and regulation dominate the conversation -- on Wall Street, main street, and Pennsylvania Avenue."23 We are now told that America can survive only with more government tentacles and dogooders and controls and rules and programs to help save people and businesses from their own bad decisions. We're back to cradle-to-grave safety nets and cradle-to-grave dependency.

Consider the financial and political fallout from the subprime mortgage crisis. A subprime mortgage is a mortgage given to a borrower with a less-than-stellar credit rating, hence sub, or below, prime. Over the last two to three years, while real estate prices were setting records around the country, a boom in real estate financing followed closely on the heels of the rush to buy property. To capitalize on the market frenzy, lenders devised novel means of financing to help buyers purchase properties they might not otherwise have been able to afford.

But home prices went down, not up, as the real estate crisis spread, and now millions of Americans have mortgages that are more than what the house is actually worth. No bank is going to refinance a house for an amount higher than what it is worth. To add to the misery, subprime mortgage interest rates ballooned, hiking payments on the original loan, which many borrowers couldn't afford. What happened in thousands upon thousands of cases is that the hapless owner dropped the keys off at the bank ("jingle mail") and moved, likely to a rental unit. Another mortgage gone bad and another house on the block in foreclosure.

What happened to these mortgages? The bank no longer had them. The bank had sold them to some clever Wall Street firms that packaged them into bonds with fancy names like CDOs, or Collateralized Debt Obligations. What happened next is at the heart of the subprime crisis. The wave of defaults on home mortgages cascaded into major losses for the holders of CDOs. As of early 2008, the reported writedowns of major financial institutions reached the staggering sum of $120 billion -- and the number keeps climbing. The legendary investment bank Bear Stearns, which effectively imploded in the crisis, was acquired by J. P. Morgan for ten dollars a share (down from $170 in 2007). The fortunes and retirement nest eggs of thousands of Bear Stearns executives and employees were wiped out in an instant, and Bear Stearns stock investors took a bath.

Now here is what is really scary. The federal government now wants a massive $300 billion bailout of the very banks and the borrowers who often got greedy and tried to "play the market." Congress wants the Federal Housing Administration to provide 100 percent taxpayer insurance for these failing subprime loans. Why? Doesn't this just reward the bad behavior and the greed? There are somewhere near 55 million mortgages in America, and some 52 million of those mortgages are being paid on time by conscientious and financially responsible people. Sometimes it's a hardship to make those mortgage payments. But most of us do it. So here's a question about fairness: How is it fair to make 52 million who acted responsibly and are paying their mortgages on time pay more in taxes to bail out those who acted irresponsibly? In the marketplace, if you take a risk and you win, you keep your winnings. But now government is saying if you lose, the government bails you out! This sounds like heads I win, tails the taxpayers lose.

Plummeting home prices are not the only economic adversity we face today. Oil has soared above $140 a barrel, and gasoline prices are up to $4 a gallon. Hard-pressed consumers face higher prices on such necessities as transportation and heating, increased costs they simply cannot absorb without cutting somewhere else.

Stock market volatility has soared. Daily triple-digit movement of the Dow Jones Industrial Averages, once a rare phenomenon, is now common. Indeed, declines of two hundred and even three hundred points occur with alarming regularity, offset by occasional large increases. In just the first half of 2008, Americans lost $2 trillion in wealth.

So, whither prosperity?

The Imminent Economic Danger

Today there is a widespread consensus of opinion that tougher times lie ahead. Employment is down, incomes are down, housing values are down, family incomes are down, and consumer confidence is in the tank. The only thing that seems to be up these days is the price of everything we buy, from groceries to gas.

If in this precarious financial environment a new Congress decides to impose tax increases, the effect on our economy could be devastating. Indeed, a series of tax increases, presumably on "the wealthy," could decapitate the prosperity we have enjoyed for over two decades. These tax increases will also sink the nervous stock market, and accelerate the sell-off of the shrinking dollar.

The danger is imminent and very real. One of the most serious aspects of the problem today is that major tax increases will occur if Congress doesabsolutely nothing, something it has become very adept at. The Bush tax cuts that reduced the tax on capital gains and dividends to 15 percent will simply expire after 2010 if nothing is done to extend them. That would mean that the capital gains tax rate will go from 15 percent to 20 percent, and the dividend tax rate will go from 15 percent back to 39.6 percent or higher for top earners. Barack Obama has suggested raising the capital gains tax rate to as high as 28 percent -- higher than the rate when Bill Clinton left office.

Arguably the cruelest tax increase of all will be the death tax increase. The death tax has been declining each year under the Bush tax cuts. In 2010, that tax reaches 0 percent. But, if nothing is done to extend the tax cut, the death tax jumps from 0 percent to 55 percent in 2011. It takes little imagination to understand that in these automatic tax increases, which require no action or initiative, we have the makings of an economic calamity.

Is There a 50 Percent Tax "Baracket" in Your Future?

Under the Obama tax plan that is spelled out in detail on his website, tax rates on income will go back to as high as 50 to 60 percent. Senator Obama believes that " there's no doubt that the tax system has been skewed. And the Bush tax cuts -- people didn't need them, and they weren't even asking for them, and that's why they need to be less, so that we can pay for universal health care and other initiatives."

But it could be worse than that. Note these frightening comments by a Democratic "thought leader" and former secretary of labor, economist Robert Reich (Steve Moore's "dynamic duo" debate partner each week on CNBC TV). Reich wrote in December 2006 about the need for "An Economic Populism" (ughh!) to "level the playing field" in education, health care, and the workplace:

And to pay for all of this, and guarantee upward mobility, the tax system would have to be made far more progressive than it is today -- starting with excusing the first $20,000 of income from payroll taxes and removing the $100,000 cap on those taxes, and getting back toward the 70 to 90 percent marginal tax on the highest incomes we had under Eisenhower and JFK.

We think the solution to our economic problems lies 180 degrees in the opposite direction. We favor a low flat tax with everyone paying the same low tax rate. If you make more money, you pay higher taxes, but at the same rate. No more tax shelters. We will show how America could impose a flat tax of just 12 percent on business activity and household income and still generate enough money to run the government. Imagine America with a 12 percent tax rate. Our economy would fly as if powered by rocket fuel.

But the Left says it wants progressive taxes that get higher and higher as incomes rise. In the Eisenhower administration, that rate was as high as 91 percent, and Reich suggests that we go back there! So how hard would you want to work for that last dollar of income if the government would take away ninety-onecents of every last dollar you earned? It is frightening to think that some Democratic leaders are seriously suggesting a return to that type of confiscatory taxation.

Doesn't the flat tax make much more sense?

Fair Trade Means No Trade

In August 2007 Senator Barack Obama launched this rant against free trade:

Look, people don't want a cheaper Tshirt if they're losing a job in the process. They would rather have the job and pay a little bit more for a Tshirt. And I think that's something that all Americans could agree to.

Really? Well, let's push this example a little farther. Would Americans mind paying "a little bit more" for their cars to keep Americans employed? And what about plasma TVs, home appliances, clothing, and food? Where would this lead? You know the answer. We would become an economy that produces products that are uncompetitive and with zero export value. What would happen to jobs then?

Trade protectionism crosses party lines. Republican presidential candidate Mike Huckabee won the Iowa caucuses running on a message of trade protectionism.

The people who are victimized the most by trade barriers and tariffs are the poor. They are the ones who benefit the most from the lowering of prices that free trade brings. From 2001 to 2006 the prices of food, clothing, and basic modern conveniences like appliances fell, and that is in large part due to the forces of global competition that hold down prices. It is ordinary people who shop at Wal-Mart and harness the greatest economic gain from the low prices of imports from China. In many ways international trade and discount stores like Wal-Mart that sell imported goods have done more to alleviate poverty in America than all the Great Society programs wrapped together. Why don't Barack Obama or Nancy Pelosi or Mike Huckabee or the union chiefs understand this?

We hope the reader can see already that our book is not meant to make a partisan case for one political party over the other. Yes, Barack Obama and Hillary Clinton and Nancy Pelosi scare us. But there are a lot of DemocratsandRepublicans we also think don't have their tray tables in the upright and locked position when it comes to understanding sound economics. The warning we also give here is offered to both parties. It is a call to arms, an appeal to reason to all Americans, and especially to those who seek public office.

If we allow higher taxes, we will face higher unemployment, plus lower or even negative growth, and a declining stock market that will affect Americans at all economic levels, from stock and mutual fund investors to those Americans who depend on their pensions, IRAs, and 401(k)s to ensure their comfortable retirement. Remember, over half of Americans today are investors in the stock market. The best prescription for their investments and for continuing a strong economy is lower taxes and free trade.

Read on.

Heed this message.

Please!

Copyright © 2008 by Arthur B. Laffer, Stephen Moore, and Peter J. Tanous

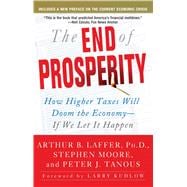

Excerpted from The End of Prosperity: How Higher Taxes Will Doom the Economy--If We Let It Happen by Arthur B. Laffer, Stephen Moore, Peter Tanous

All rights reserved by the original copyright owners. Excerpts are provided for display purposes only and may not be reproduced, reprinted or distributed without the written permission of the publisher.