Livermore went bankrupt for at least the fourth time in 1934. Despite having amassed a fortune of $100 million by1929, Livermore was back where he started at 16. He did not seem to learn from his

mistakes."—Victor Niederhoffer

"That was the call of a lifetime, everyone was blind and deep into the crisis and Jesse Livermore

made $100 million going short when almost everyone else was bullish and then almost everyone else lost their shirts."—John Paulson

"His stories of making millions, were the financial equivalent of “sex, drugs and rock ‘n roll” to a

young man at the advent of his financial career."—Paul Tudor Jones

"It was an amazing day on 24th October 1929 when Jesse came home and his

wife thought they were ruined and instead he had the second best trading day

of anyone in history."—John Templeton

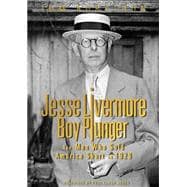

Who was Jesse Livermore?

Jesse Livermore, was the most successful stock and commodities

trader that ever operated on the stock markets. He was both the

man who made the most money in a single day and the man who

lost the most money in a single day. In fact he made and lost three

great fortunes between 1900 and 1940.

Singlehandedly he caused the two great Wall Street crashes of

1907 and 1929, making millions from both. When he speculated he

speculated big and was known on Wall Street as the Boy Plunger.

For a brief period in the early 1930s he was one of the world’s

richest men with a personal fortune believed to be worth over

$150 million, $100 million of that earned in just a few days from

the Wall Street crash of 1929. In the end it was too extreme a

change of fortunes for any man to cope with and Livermore shot

himself in a New York hotel lobby in 1940 aged just 63. His legacy

continued and his son, Jesse jr later also committed suicide as

did his grandson, Jesse III.

In the summer of 1929 most people believed that the stock market would

continue to rise forever. Wall Street was enjoying a eight-year winning run

that had seen the Dow Jones increase 1,000 per cent from the start of

the decade - an unprecedented rise. The Dow peaked at 381 on 3rd

September and later that day the most respected economist of the day,

Irving Fisher, declared that the rise was “permanent”. One man vigorously

disagreed and sold $300 million worth of shares short. Two weeks later the

market began falling and rising again on successive days for no apparent

reason. This situation endured for a month until what became famously

known as the three ‘black’ days: On Black Thursday 24th October the Dow

fell 11% at the opening bell, prompting absolute chaos. The fall was stalled

when leading financiers of the day clubbed together to buy huge quantities

of shares. But it was short-lived succor and over that weekend blanket

negative newspaper commentary caused the second of the ‘black’ days

on Black Monday 26th October when the market dropped another 13%.

The third ‘black’ day, Black Tuesday 29th October saw the market drop a

further 12%. When the dust had settled, between the 24th and 29th October,

Wall Street had lost $30 billion. Only much later did it became known

that the man who had sold short $300 million worth of shares was Jesse

Livermore. Livermore had made $100 million and overnight became one

of the richest men in the world. It remains, adjusted for inflation, the most

money ever made by any individual in a period of seven days. This is the

story of that man.