Note: Supplemental materials are not guaranteed with Rental or Used book purchases.

Purchase Benefits

What is included with this book?

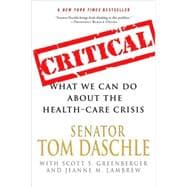

Tom Daschle is a former U.S. Senator and Senate majority leader from South Dakota. He is currently a special policy advisor at the law firm Alston & Bird LLP, a visiting professor at the Georgetown Public Policy Institute, and a Distinguished Senior Fellow at the Center for American Progress.

Jeanne M. Lambrew is an associate professor at the Lyndon B. Johnson School of Public Affairs at the University of Texas. Dr. Lambrew is also a senior fellow at the Center for American Progress. Previously, she worked on health policy at the White House as the program associate director for health at the Office of Management and Budget (OMB) and as the senior health analyst at the National Economic Council.

Scott S. Greenberger, a former staff reporter at The Boston Globe, is a writer and consultant at Ricchetti, Inc., in Washington, D.C.

The New copy of this book will include any supplemental materials advertised. Please check the title of the book to determine if it should include any access cards, study guides, lab manuals, CDs, etc.

The Used, Rental and eBook copies of this book are not guaranteed to include any supplemental materials. Typically, only the book itself is included. This is true even if the title states it includes any access cards, study guides, lab manuals, CDs, etc.