Note: Supplemental materials are not guaranteed with Rental or Used book purchases.

Purchase Benefits

What is included with this book?

| Introduction | p. 1 |

| Getting to Know You All Over Again | |

| The Truth About Financial Infidelity | p. 7 |

| Discovering Your Money Personality | p. 23 |

| When Money Personalities Collide | p. 53 |

| Digging Deeper | |

| How Bad Is It? Finding Your Financial Infidelity Quotient | p. 85 |

| Confronting the Causes of Financial Infidelity | p. 95 |

| Starting Again | |

| Eight Simple Rules for Fighting Fair | p. 125 |

| The Money Dump: Getting It All on the Table | p. 139 |

| The Key to Restoring Your Financial Relationship | p. 151 |

| Appendices | |

| Money Personalities at a Glance | p. 171 |

| Money Huddle Quick Tips | p. 173 |

| The Money Couple Answers Your Questions | p. 177 |

| Acknowledgments | p. 191 |

| Notes | p. 193 |

| Table of Contents provided by Ingram. All Rights Reserved. |

The New copy of this book will include any supplemental materials advertised. Please check the title of the book to determine if it should include any access cards, study guides, lab manuals, CDs, etc.

The Used, Rental and eBook copies of this book are not guaranteed to include any supplemental materials. Typically, only the book itself is included. This is true even if the title states it includes any access cards, study guides, lab manuals, CDs, etc.

Chapter One

The Truth About Financial Infidelity

It's the kind of phone call you hope you never get. Shannon,an acquaintance, called me to ask for help with her finances. "Bethany, I just found out that Michael has gotten us into some serious debt, and I need your help getting out of it."

"What kind of debt are we talking about?" I asked her.

"A little over $30,000," Shannon replied.

It was all I could do not to scream into the phone.

I quickly put on my financial adviser hat and asked her to tell me what had happened. What she said next still makes me want to throttle her husband.

"Well, a few weeks ago I got a call from the video store. They told me we still had one of their movies and that we needed to return it and pay the late fees. I asked them what movie it was and they gave me the name of something that was clearly an adult video. I told them we didn't rent movies like that and that they'd made a mistake. They called back a couple of days later, and I told them the same thing. The guy said, ‘Well, then someone stole your credit card because this is the account we have in our records.' So I went to the video store to straighten them out. I talked to the manager, and he showed me the signature on the rental agreement. It was Michael's."

Shannon went on to tell me that the devastation she felt at the video store was nothing compared to what she felt next. She went home and started looking through their bills. That's when she learned that her husband, who had been in charge of their finances, was behind on car payments and life insurance payments and had a stack of unpaid credit card bills. Then she landed on a bill for a credit card she didn't know he had, a bill that included charges from pornographic Web sites. She had been lied to for years. It turned out that Michael had been using this card to fund his porn addiction without Shannon suspecting anything. Here was a marriage filled with betrayal, broken trust, and years of deception. And you know what Shannon and I talked about? Her debt.

I helped Shannon work out a long-term plan for paying off what they owed and for getting their finances back on track. It took about three years and a lot of hard work and sacrifice, but she did it. She got her family out of a financial crisis.

Most financial advisers would say this is a success story. Here was a couple with deep debt, but with hard work and a commitment to live within their budget, they recovered. I was proud of Shannon, and she was proud of herself. "Finally," she told me, "that nightmare is over and we can start fresh."

And guess what? Two years later, Michael has again run up more than $30,000 in credit card debt, back taxes, and loans taken against their retirement fund. Shannon could end up in deep legal trouble because of their tax situation. Her car has been repossessed. They barely speak to each other. Michael sleeps on the couch. Their marriage is a disaster.

Five years ago, Shannon and I both treated this as a purely financial problem. Wrong. The money mess was a symptom of something else. It was a symptom of financial infidelity.

Financial infidelity is what happens when a person drives her family into debt with her overspending. It is the lack of financial planning that leaves couples desperate. It is two people maintaining separate accounts because they don't trust each other enough to pool their resources. It is the desire to control another person's life by limiting his access to money. It is what happens any time a person lies, cheats, or deceives his partner about money. It is a betrayal of the trust that two people put in each other when they commit to a relationship. Overspending, separation, lack of planning, control, and secrets—these forms of financial betrayal can be just as damaging to that trust as sexual betrayal.

We own a financial planning company with tens of thousands of clients all over the world. We work with incredibly wealthy people and people who have almost nothing. And we can tell you that financial infidelity is everywhere. Take a look at these numbers: 51 percent of all marriages in the United States end in divorce. The top cause of divorce? Money.1 Nearly 75 percent of couples in the United States cite money as the primary cause of their marital fighting.2 And among financial planners like us, more than 40 percent say money is the primary reason their clients seek divorce. It's the rare couple that doesn't deal with some kind of financial infidelity.

Financial infidelity seldom happens abruptly. It sneaks into a relationship without warning. It creeps in through those little lies, those seemingly harmless secrets that couples have about money. It starts when a guy gets a private credit card. He convinces himself he'll only charge $100 a month. But then the $100 turns into $500 and the $500 into $5,000, and the spiral just keeps swirling down. It starts when a woman tells her partner she spent $50 at the mall instead of the $175 she really dropped because she doesn't want him to get mad at her. It starts when he hides the real depth of the debt he's bringing into the relationship or when she refuses to participate in managing their family finances. Just like sexual infidelity starts with an innocent business lunch or a little flirtation over coffee, financial infidelity begins with that first secret, that first half truth, that first hidden purchase.

The first betrayal leads to the next and to the next, and before long, the relationship is dying.

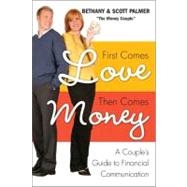

First Comes Love, Then Comes Money

Excerpted from First Comes Love, Then Comes Money: A Couple's Guide to Financial Communication by Bethany Palmer, Scott Palmer

All rights reserved by the original copyright owners. Excerpts are provided for display purposes only and may not be reproduced, reprinted or distributed without the written permission of the publisher.