Note: Supplemental materials are not guaranteed with Rental or Used book purchases.

Purchase Benefits

What is included with this book?

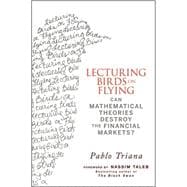

Pablo Triana has successful derivatives ex-perience at all levels: on the trading floor and as a professor, consultant, and author. He is a frequent contributor to business publications, including the Financial Times, Forbes.com, Breakingviews.com, and Risk magazine, among others. Triana is also the author of Corporate Derivatives. He holds a master of science from the Stern School of Business, New York University, and a master of arts from American University.

| Foreword | p. XI |

| Preface: An Evening at NYU, Taleb's Article, and a Credit Crisis | p. XIX |

| Mathew Gladstein's Complaisance | p. XLIII |

| Essentials | |

| Playing God | p. 3 |

| It's tough to model human action | |

| Finance is not as religious as physics | |

| Black Swans make things harder | |

| The markets are not Normal and the past is a faulty guide | |

| Should we care that theorists persist? | |

| The Financial Economics Fiefdom | p. 29 |

| Virginity matters | |

| When describing reality was okay | |

| It's the incentives, stupid | |

| Many obstacles to reform | |

| Heeding Fischer Black's message | |

| Quant Invasion | p. 59 |

| Machine learning comes to finance | |

| It's a computational thing | |

| Models live here, too | |

| Quant punting | |

| Interesting enough for a movie | |

| Critique | |

| Copulated Nightmares | p. 93 |

| Abrupt reform, if not so much prison | |

| Modeling death | |

| The 2005 pre-warning | |

| Rating us into hell | |

| A disapproving grin | |

| Blah VaR Blah | p. 127 |

| Insalubrious charlatanism | |

| Tracking a true culprit | |

| Credit truths | |

| A long rap sheet of evidence | |

| The police are in on it | |

| Blue Is Not Green | p. 161 |

| Lehman did die | |

| Anything is possible | |

| Buffett versus the Black Swan | |

| Stubbornly holding the theoretical fort | |

| An end to indoctrination | |

| The Black-Scholes Conundrum | p. 177 |

| Once upon a time at MIT | |

| Frowning, not smiling | |

| How Black was that Monday | |

| A devastating KO | |

| The Taleb & Haug critique | |

| Conclusions | |

| Black Swan Deceit? | p. 245 |

| The tired "perfect storm" alibi may be a facade | |

| Indoctrinating clients and investors | |

| The unseemly marketers of academic dogma | |

| Do as I say, not as I do | |

| Glorifying complexity | |

| An Unhealthy Yearning for Precision | p. 267 |

| Dangerous voluntary enslavement | |

| Let freedom ring | |

| Normality can kill you | |

| A VIXing issue | |

| Protect those derivatives | |

| We Need Fat Tony | p. 297 |

| Finale Should The Nobel Prize in Economics Be Eliminated? | p. 305 |

| Notes | p. 319 |

| Acknowledgments | p. 335 |

| About the Author | p. 337 |

| Index | p. 339 |

| Table of Contents provided by Ingram. All Rights Reserved. |

The New copy of this book will include any supplemental materials advertised. Please check the title of the book to determine if it should include any access cards, study guides, lab manuals, CDs, etc.

The Used, Rental and eBook copies of this book are not guaranteed to include any supplemental materials. Typically, only the book itself is included. This is true even if the title states it includes any access cards, study guides, lab manuals, CDs, etc.